After nearly 20 years of working directly with small businesses and individuals, here is the number one reason small businesses and entrepreneurs fail. I will share the reasons and the top strategies to avoid these reasons. First I will talk about traditional brick and mortar and 2nd I will talk about entrepreneurs in general, including internet, marketing, product sellers, affiliates and any other kind of individual starting a business.

Traditional Business

The reason most small businesses fail is really very simple and consistent: Under Capitalization. The majority of businesses under 3 years old that paid me to come In and analyze or re-engineer the business, had good products. So the real reason the business was failing had less to do with the product and more to do with how the business was being run, especially within the first 12 to 24 months, which is a critical period for all businesses. Once I sat down and talked to all the key employees and looked at the initial pro forma financial projections, including owners equity and capitalization. A gaping hole was obvious: sufficient capital reserves to cover operation shortfall.

Most small businesses do a great job of estimating expenses to get the doors open and the lease established, but conversely do a poor job of building in Cashflow reserves sufficient to cover operations for At least 12 months of full operation. Now when I say full operation, I mean operations when the company has established an operating rhythm or business cycle. For most companies this smoothing out of processes takes about 90 days. This initial time phase is not generally a time to maximize profitably because it involves fine tuning and market launch, which inherently should include a large amount of marketing and PR initiatives designed solely to get the company name out in the marketplace. So, the reason so many small businesses fail is lack of operating cash flow to cover expenses within the first 12-24 months. If you start off behind it only gets worse as the company is forced to cut marketing and promotions too early in the timeline to effectively get the company name in the marketplace and subsequently, the company very rarely recovers from this structural flaw. The reason: having to be profitable immediately to keep the lights on puts undue pressure and stress on the business and on the business owners. The fun is sucked right out if the business from the very beginning! This great idea that you had been entertaining for years and finally got up the initiative and courage to launch is no longer what you signed up for within 90- 120 days of launch! If you go out and get loans to cover the shortfall, the interest payments can become an albatross on the cash flow health of the long-term business if the structure doesn’t improve, and may even hasten the time to business closure.

So how do we fix this ? Before I give you my answer based on actual cases, I’d like to hear your comments or questions .. Then we will pick back up and finish this brick and mitts segment and then move on to individuals, where the similarities are uncanny…

Comments? Questions?

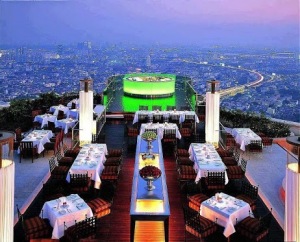

The view from the top http://www.facebook.com/moneydecoded

In Abundance,

Anson Massey